Share this

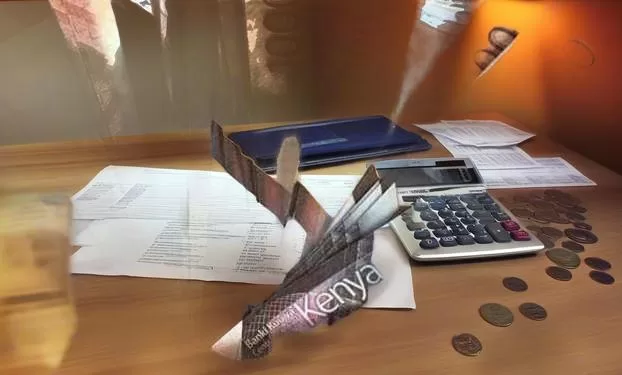

Do you ever feel like your money no longer does what it used to for you? Everything seems to cost a ten bob to fifty bob more than it did a year ago. But on the flip side of things, our incomes have stayed exactly where they were if not even reduced with the new levies and stuff.

This though is not just a Kenyan problem, watching international news you get the feeling that the global economy is struggling. Hence, saving money in whichever way possible has become more important.

Every penny counts, and finding ways to reduce unnecessary expenses and costs can significantly impact your financial health. Whether it’s cutting down on daily costs, finding better deals, or taking advantage of financial services that offer more value.

Every effort towards saving or stretching your income can help you navigate these challenging economic times more effectively.

An average Kenyan youth makes about Kes. 50,000 there about every month. They spend an average of Kes. 18,000 in rent for their one-bedroom apartment in Ruaka.

Their monthly shopping and utilities costs Kes. 5,000 and Kes. 2,000 respectively. They also have set aside Kes. 10,000 for transport and have a black tax budget of about Kes.

5,000 monthly. Additionally, they use Kes. 5,000 for sherehe and save the remaining Kes. 5,000 for a rainy day. Not a decent amount that can get you out of a jam if you ask me.

With all that in mind, how can someone save more? There are a few tips and tricks to ensure that you stretch every coin, most people have hacked this by looking out for offers.

For instance, many brands or stores have mid-year sales and black Friday sales that aim to save their customers a few shillings, look out for these when doing your shopping.

Another hack would be using money in the same ecosystem to save money on transaction charges. For instance, if you bank with Equity, you can benefit a lot from their zero transaction costs for Equity-to-Equity transfers and payments.

It may look negligeable, but we do spend a lot of money on transaction costs whenever we move money from our bank accounts to mobile wallets to make payments or send money to our loved ones.

Whether transferring money from your Equity bank account to another Equity Bank account, through Equitel line, Equity Mobile App or USSD (*247#) to a friend, family member or your local mama mboga, its absolutely FREE!

So next time you want to send your parent or siblings cash, how about you ask them if they have an Equity bank account? You will save on transaction costs there. When paying for your groceries, ask the mama mboga if they have an Equity account.

Just doing some quick math on my financial transaction costs, I realized I spend about Kes 800 every month. In a year, that would be Kes. 9,600.

What does this translate to in the current economic status? This would be enough for a return ticket via SGR to Mombasa for your December holiday. Could be a whole goat for your Christmas sherehe with the family or almost two months’ worth of your grocery shopping – imagine cruising through Njaanuary courtesy of your savings on transaction costs!

Money doesn’t come easy, so whenever you find a way to save an extra coin, run with it!